Offshore structures and beneficial ownership

-

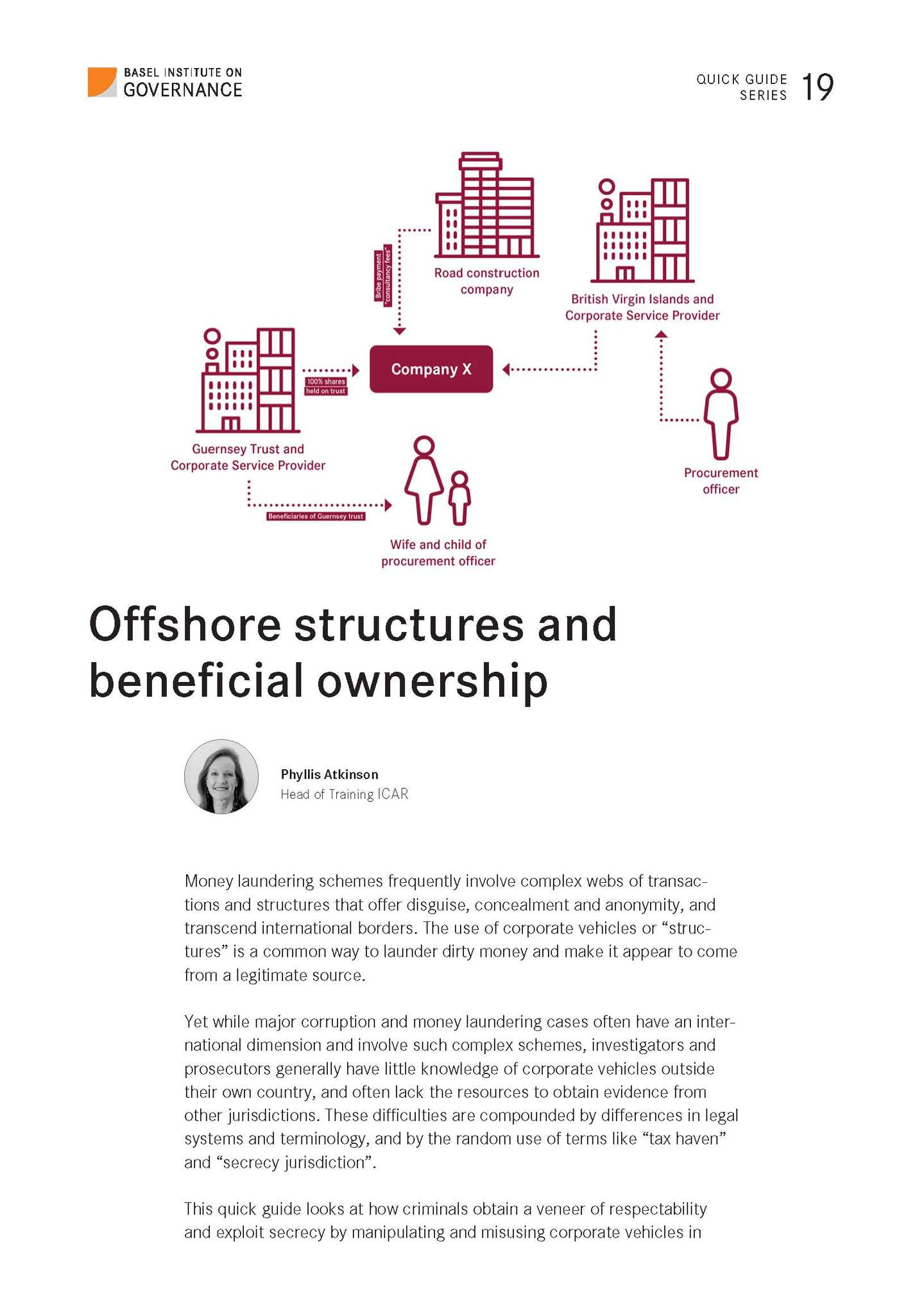

Money laundering schemes frequently involve complex webs of transactions and structures that offer disguise, concealment and anonymity, and transcend international borders. The use of corporate vehicles or “structures” is a common way to launder dirty money and make it appear to come from a legitimate source.

Yet while major corruption and money laundering cases often have an international dimension and involve such complex schemes, investigators and prosecutors generally have little knowledge of corporate vehicles outside their own country, and often lack the resources to obtain evidence from other jurisdictions. These difficulties are compounded by differences in legal systems and terminology, and by the random use of terms like “tax haven” and “secrecy jurisdiction”.

This quick guide looks at how criminals obtain a veneer of respectability and exploit secrecy by manipulating and misusing corporate vehicles in Offshore structures and beneficial ownership QUICK GUIDE SERIES 19 Phyllis Atkinson Head of Training ICAR offshore jurisdictions. It focuses on the meaning of “corporate vehicle” and “offshore” and other related concepts such as beneficial ownership. It also gives an example of how a trust, which is one common type of corporate vehicle in the vast “offshore ecosystem”, can be used for illicit purposes.